Who we are

ACE MARKETING & PROMOTIONS, INC. launched in 2023 with a mission to illuminate Ghana’s everyday money decisions through relatable education. We are a small, focused team that combines marketing insights, financial literacy research, and human-centered design to deliver content that resonates with students, emerging professionals, and informal sector entrepreneurs alike.

Our first year has been dedicated to co-creating resources with learners across Greater Accra, Northern Region, and the Ashanti Region. We prioritise listening sessions, community workshops, and feedback calls to ensure our tools remain grounded in actual budget pressures and cultural expectations.

Understanding Ghana’s financial landscape

Ghana’s dynamic economy invites citizens to juggle multiple income streams while navigating obligations to extended family, religious communities, and social groups. Our work reflects this complexity. We study trends such as mobile money adoption, utility tariff adjustments, transport fare revisions, and PAYE regulation changes, and we translate them into simple explanations that lend clarity.

Community-first design

We hold focus groups in markets, campuses, and coworking hubs to listen to the money stories that often remain undocumented. These insights shape our examples and tone.

Data with context

We pair datasets from the Bank of Ghana, Ghana Statistical Service, and reputable NGOs with lived experiences shared by our learners to ensure numbers make sense in daily life.

Respect for obligations

We acknowledge the importance of funeral contributions, festive gatherings, and community dues. Our budgeting templates make room for such commitments without judgment.

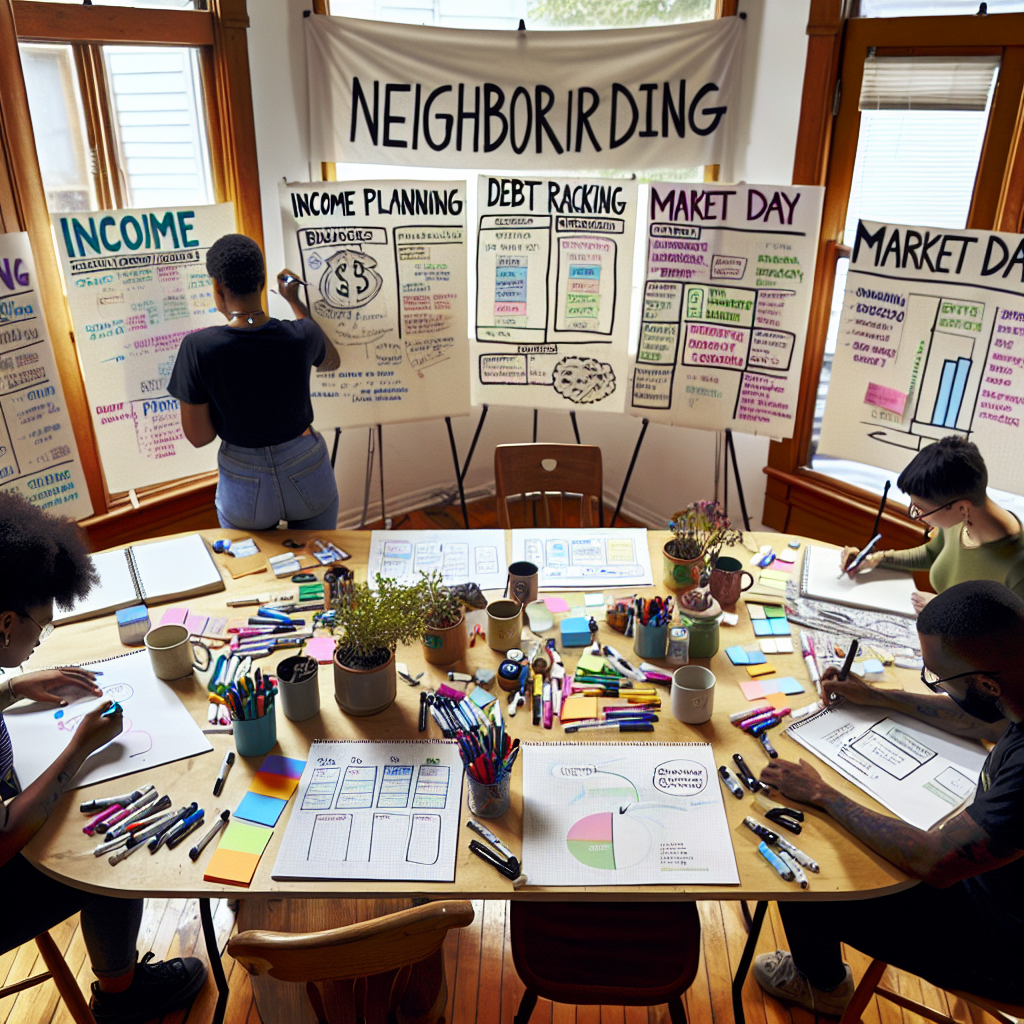

How we work with learners

Our approach combines storytelling, technology, and careful facilitation. We design each lesson with diagrams, conversation prompts, and exercises that prompt participants to imagine their future possibilities while safeguarding present responsibilities.

- Interactive workshops blending digital demonstrations and tactile worksheets.

- Scenario simulations that mirror market day fluctuations, salary delays, or school term demands.

- Post-session check-ins to assess adoption and co-create adjustments.

We also collaborate with local trainers and language facilitators to make sure learners can engage fully, whether sessions are in English, Twi, Ewe, Ga, or Dagbani.

Milestones from our first year

Listening labs

Hosted listening sessions in Accra and Kumasi to map financial stress points among young professionals and traders.

Pilot toolkit release

Launched the first version of our budgeting and debt tracking toolkit with five partner groups.

Workplace clinics

Delivered bespoke clinics for corporate wellness programmes that addressed salary structures and group savings clubs.

Platform refinement

Upgraded kernellumen.com with advanced calculators and expanded guidance for rural and peri-urban communities.

Values guiding every lesson

Empathy

We believe financial education is more powerful when it acknowledges cultural obligations and diverse income streams without bias.

Integrity

We share transparent methodologies, cite our data sources, and clarify when learners should consult licensed financial professionals.

Practicality

Our tools focus on daily decisions, ensuring that recommendations can be implemented with existing resources and technology.

Collaboration

We build alliances with community groups, workplaces, and educational institutions to amplify impact across Ghana.

Looking ahead

Our roadmap includes expanding vernacular translations, enriching our savings challenge library, and developing sector-specific kits for agribusiness, creative industries, and public servants. We will continue to monitor policy changes and macroeconomic shifts to keep our learners informed without overwhelming them.

We welcome partnerships with civic groups, universities, financial cooperatives, and NGOs who share our commitment to sustainable financial literacy. If you are aligned with this vision, we would love to hear from you.

Connect with us